Vital Statistics:

|

Last

|

Change

|

Percent

|

|

|

S&P Futures

|

1782.3

|

2.0

|

0.11%

|

|

Eurostoxx Index

|

2961.3

|

-17.4

|

-0.59%

|

|

Oil (WTI)

|

97.44

|

0.0

|

-0.04%

|

|

LIBOR

|

0.244

|

0.002

|

0.62%

|

|

US Dollar Index (DXY)

|

80.13

|

0.059

|

0.07%

|

|

10 Year Govt Bond Yield

|

2.87%

|

-0.01%

|

|

|

Current Coupon Ginnie Mae TBA

|

104.7

|

0.0

|

|

|

Current Coupon Fannie Mae TBA

|

103.4

|

0.1

|

|

|

RPX Composite Real Estate Index

|

200.7

|

-0.2

|

|

|

BankRate 30 Year Fixed Rate Mortgage

|

4.48

|

Markets are

little changed this morning ahead of the start of the FOMC meeting. Consumer

Prices were unch'd.

The GSEs are

planning on reducing

the upper limits sometime

next fall. They are thinking of dropping the high cost ceiling from

625k to 600k and the overall ceiling from 417k to 400k. They are inviting

public comment. Setting new purchase limits "furthers the goal of

contracting the market presence of Fannie Mae and Freddie Mac gradually over

time, one of the key objectives of FHFA's strategic plan."

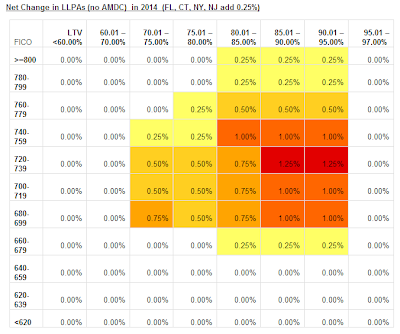

Fannnie Mae and

Freddie Mac also released their new pricing adjustments today, (Fannie is here, Freddie

is here) which increases costs for borrowers in 2014. The first part is a

g-fee increase of 10bp. The second is a series of LLPAs to better reflect credit

risk. Note the Adverse Charge goes away for all states except CT, FL, NY, and

NJ. However, when you include

the new LLPAs, conforming loan rates are going up. Mortgage News Daily put

out this handy chart showing the new adjustments. Note that these are not the

actual adjustments - they are the change in adjustments. Note that higher LTV

loans with FICOs over 680 are getting socked.

Toss

in the potential effects of QE tapering and conforming loans just got a lot

more expensive. LOs get ready for this new pricing regime.

A

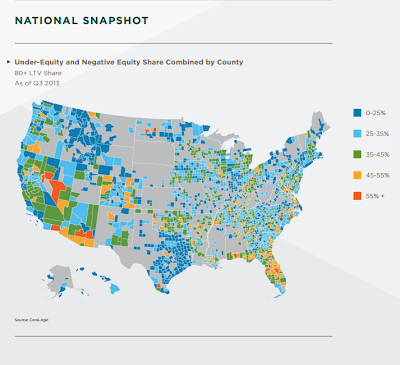

total of 791,000 homes returned to positive equity in the third quarter, according

to CoreLogic. This leaves a total of 6.4 million homes (or about 13% of all

mortgaged homes) with negative equity. This compares to 7.2 million homes (or

14.7%) a year ago. You can see the distribution of negative equity MSAs in the

chart below:

The

budget deal is looking more

and more likely to pass the Senate. That doesn't necessarily mean smooth

sailing ahead - Republican lawmakers who are angry about the budget deal are spoiling

for a fight over the debt

ceiling. CNBC also has a lay of

the land. The big strategic question for the GOP remains obamacare - if it

continues to flail and have issues, do Republicans go along with a debt ceiling

increase for fear of changing the subject, or would they view this as an

opportunity to slay the unpopular ACA

dragon once and for all?

When

people think of Detroit, they often think of the hapless Lions, but also the

Packard Plant, which went dormant in 1956 and is ruins remain a testament to

urban decay and is a symbol of Rust Belt misery. It

just got bought for $405,000. He plans to revitalize Detroit's East Side.

Good luck with that...

Brent Nyitray, CFA

Director of Capital Markets

iDirect Home Loans

National Asset Direct

Dellacamera Capital Management

1010 Washington Blvd, 6th Floor

Stamford, CT 06901

203-817-3614 (w)