Vital Statistics:

|

Last

|

Change

|

Percent

|

|

|

S&P Futures

|

1781.7

|

0.9

|

0.05%

|

|

Eurostoxx Index

|

2925.8

|

-21.6

|

-0.73%

|

|

Oil (WTI)

|

97.77

|

0.3

|

0.34%

|

|

LIBOR

|

0.243

|

-0.001

|

-0.41%

|

|

US Dollar Index (DXY)

|

79.98

|

0.089

|

0.11%

|

|

10 Year Govt Bond Yield

|

2.87%

|

0.01%

|

|

|

Current Coupon Ginnie Mae TBA

|

104.4

|

-0.1

|

|

|

Current Coupon Fannie Mae TBA

|

103.3

|

-0.1

|

|

|

RPX Composite Real Estate Index

|

200.7

|

-0.2

|

|

|

BankRate 30 Year Fixed Rate Mortgage

|

4.45

|

Markets are

higher this morning after a good retail sales report. Initial Jobless Claims

rose to 368k from 320k the week before. Import prices fell. Bonds and MBS are

lower.

Stanley

Fischer is mooted to be the next Vice Chairman of the Fed. He ran the Bank

of Israel through the 2008 financial crisis, and his international experience

is supposedly one of the reasons why Obama is interested in him. He has a

experience teaching at free-market leaning University of Chicago, and

left-leaning MIT. Supposedly he is skeptical of the new Fed communications

strategy, which could put him in conflict with Janet Yellen. He has called QE

"dangerous, but necessary."

In the "now

they tell us" category, QE has made

the traditional method of tightening ineffective. When the Fed wants to

tighten monetary policy, it would meter out the amount of money flowing into

and out of the banking system on a daily basis. The Federal Funds rate was

essentially the gauge they would use. Since the Fed has injected multiple

trillions of liquidity into the system, the old methodology won't work, unless

they significantly drain the system, which would be disruptive to say the

least. Instead it plans to repo its vast security portfolio in order to pull

liquidity out of the system. Of course this won't matter for a couple of years,

but it just goes to show how much QE has changed the landscape. You can see

just how much the Fed's balance sheet has ballooned below:

A Reuters poll of 60 economists shows they expect

growth to accelerate in 2014, with GDP hitting 2.5% in Q1 and reaching 3% by

year end. Continued recovery in housing, along with a pick up in capital

expenditures are the keys. The consumer de-leveraging continues. You can see

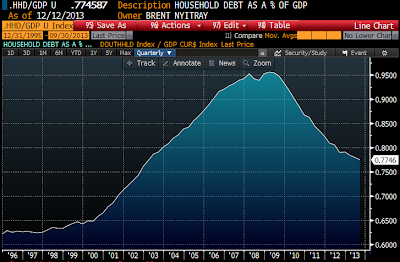

that household debt has fallen to 77% of GDP and is back at 2003 levels.

Brent Nyitray, CFA

Director of Capital Markets

iDirect Home Loans

National Asset Direct

Dellacamera Capital Management

1010 Washington Blvd, 6th Floor

Stamford, CT 06901

203-817-3614 (w)

917-841-4938 (c)

No comments:

Post a Comment